High level “

numbers DON’T speak for themselves” and tend to hide many problems that the ecosystem has and eludes us from working in the right directions to solve them.

In this article I propose a new perspective on the How to Web #VentureReport results.

Approximately 2 weeks have passed since the @HowToWeb team published the 2024 edition of the Venture Report. It is the second edition when the scope is CEE and the first one in partnership with InfoBip. We, at ROCA X, are grateful for the efforts made by industry representatives to make this report a reality and we have supported this initiative from the beginning by sharing data transparently on all our deals as we believe in the importance of monitoring the progress of the venture ecosystem, understanding the bottlenecks and the opportunities to grow, the funding trends, top players, and market shifts shaping the region. 📈

And with this sense of responsibility and drive to support the development of the Romanian ecosystem, I have to say that “

the numbers DON’T speak for themselves”. These very high-level numbers such as total volume of investment over a year tend to hide many problems that the ecosystem has and eludes us from working in the right directions to solve them.

If we follow the YoY evolution, we notice that deal volumes this year include transactions that do not represent the Romanian ecosystem (eg FilmChain - 3M eur, Swisspod - 1.6M eur) as they are not local products, they are not Romanian companies at origin nor they have significant Romanian footprint, while only a portion of their capital came from Romania. Having some of the founders of Romanian origin, but studying, working, living and qualifying as companies from UK, Swiss or US means that either DataBricks is missing from the report, or these companies shouldn’t be subject of a report with the title “Romanian Venture Deals”.

Also, over the previous years, the focus has been on tech, primarily software companies in the report. In this last edition we can find in the top transactions list companies like Moov Leasing €5M or Inki.tech €1.6M which although are companies using technology (and who isn’t these days) don’t quite fit the profile of a tech startup ecosystem. If we move this conversation a level up to the Unicorn list, we start discovering that while some reports mention UiPath as the sole Unicorn born in Romania, others like this article from Mediafax

https://www.mediafax.ro/economic/romania-are-sapte-unicorni-care-provin-din-retail-industrie-tehnologie-si-servicii-21362493 list all Romanian companies worth more than 1 billion as Unicrons with a list including also Paval Holding, Bitdefender, Banca Transilvania, Superbet, Altex Romania, Cimcomplex, and leaving outside eMag.

This highlights the need to have common standards for the definition of terms, as well as for reporting methodologies.

So, in terms of research method, we need to look beyond investment values. It would be interesting to count the number of companies that have graduated from the plethora of incubation and acceleration initiatives. What is the rate of companies graduating from these ecosystem support institutions receiving investments from a 3

rd party in one year from graduation and how many of the early rounds are going directly into companies that haven’t passed through these support institutions? Since the financing sources are still very narrow, maybe getting investment rounds will not be the only relevant KPI and we should look further at how many of these companies break some revenue barriers like €500k or €1M and they remain active companies for years showing that the potential of the talent and ecosystem is limited by the lack of financing…. Not to say about their yearly growth rate, trying to identify patterns to better anticipate the evolution of such companies.

Looking back, the data has been always distorted by the big rounds and now more than ever we can see that the little movement that happened in 2024 in the market has happened in the upper echelons of the venture with Series B, C, D, E and F representing 65% of the total funding of the year. If we add also the 16.2% of Series A, we have 81% of the total money invested in the region in advanced rounds, showing also the risk adversity of the regional players. One may say that it is normal for the larger later rounds to have a significant percentage of the total investments.

However, if we correlated the 2.7% pre-seed deals in CEE and 5% in Romania with the fact that 90% of the total investments have been follow-on rounds, we can realize the endemic lack of funding at the bottom of the pyramid, the one that needs to feed with good companies the Series A, B etc…

Drilling down from another perspective – Who financed these rounds? – we will observe again that 2024 had half of the rounds supported only by small angel syndications, crowd funding or other local private actors without any VC fund involvement and the 2023 data might have looked even worse. We have ~4 years since the announcement that the market will be flooded by the €400M PNRR money for PE&VC administered by EIF. The reality is that the execution of this program has confirmed what we intuitively knew: slow, heavy bureaucracy, rigid frameworks and untransparent restrictions for deployment means the effects of this program are yet to be seen. With just 2 Romanian VCs approved until now and just one doing pre-seed tickets, the little revamp is compensated by private players such as us Fortech, Underline and the numerous rounds of crowdfunding. It is an unrealistic expectation that the other 2 international VCs receiving mandates are going to invest heavily in pre-seed as the understanding of the ecosystem will be still limited and will never be as deep as locals with regional players.

I reiterate my point that Romania needs a solid number (10-12 coexisting) early-stage VCs professionalizing the investments at this stage, supporting proper structuring and strategies for this stage to make unicorn stories like UiPath a repeatable phenomenon, not just a lucky once-in-a-generation story.

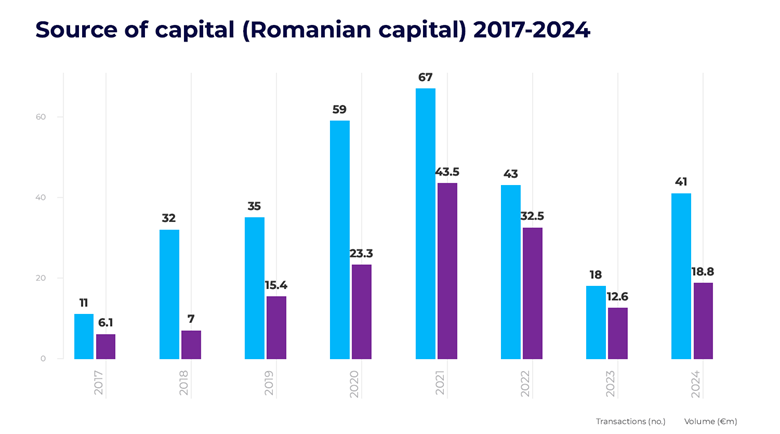

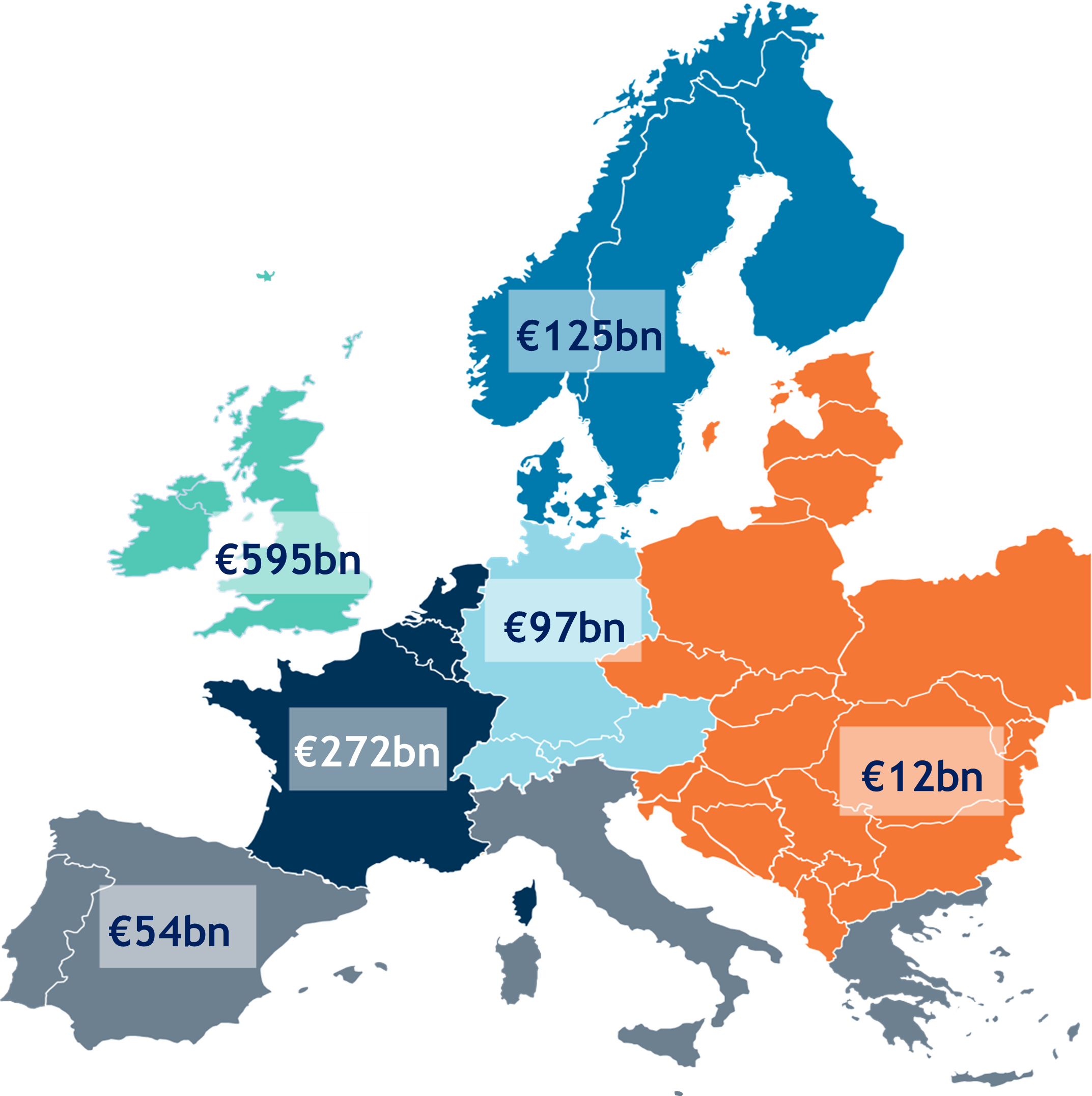

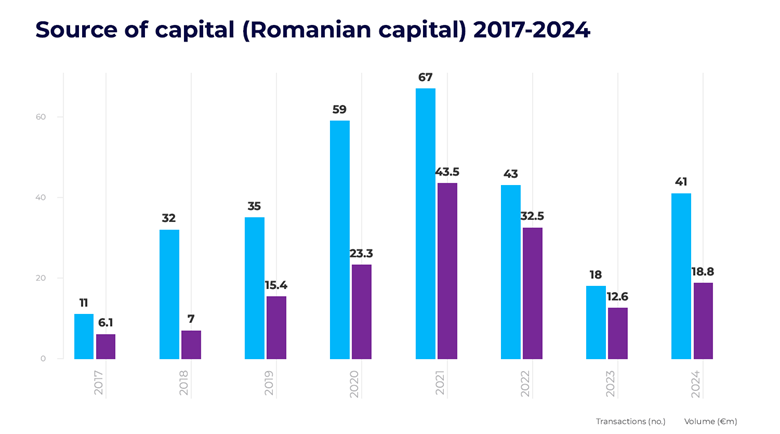

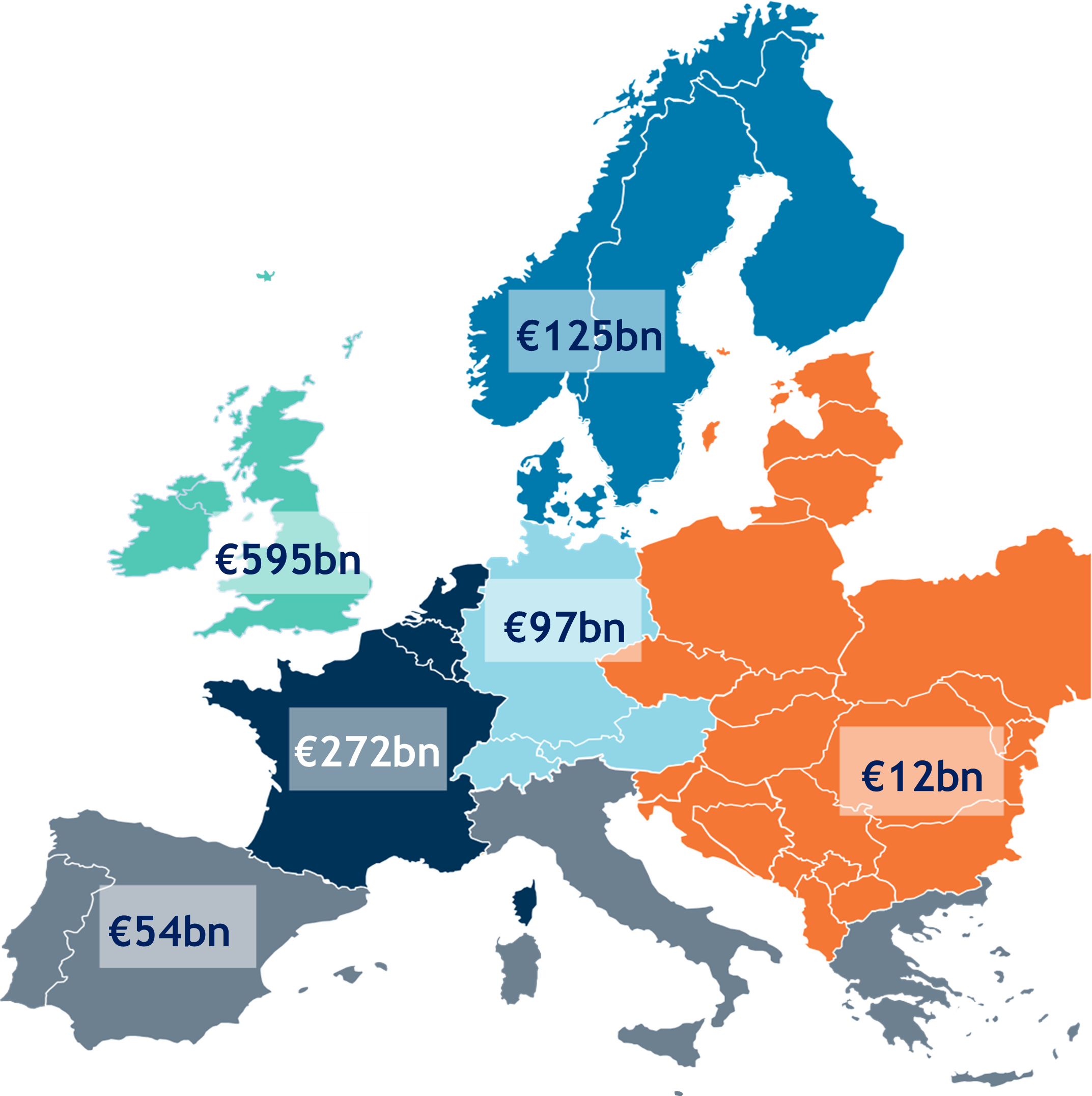

Focusing just on YoY changes like the increase by 49.6% in transaction volume with local sources of capital, we lose track of the overall ecosystem evolution and the fact that 2023 has been terrible with numbers, with only 18 deals worth €12.6M in 2023 compared to 35 deals worth 15.4M in 2019. We shouldn’t either compare everything with a peak such as 2021. But the 50% increase in 2024 to €18.8M remains less than half of the activity in 2021 and 50% less than 2022. We’ve seen corrections everywhere from 2021 to the following years, but these corrections have nowhere been as abrupt as in Romania. When we step out of the absolute value variations and we look at the GDP weight or what the size and impact of the ecosystem in the overall economy is, we see how far away from the other regional ecosystems we are, with 0.041% of GDP in Romania compared to an average of 0.072% in CEE and an average of 0.46% of GDP in wider Europe.

I still remember the first days of ROCA X in 2019 and how fast the intensity of the tech startup events and happenings was growing every week. And I do think that a huge part of that effervescence has been generated by the success of UiPath as it showed that it is possible to have a unicorn and then a decacorn from this forgotten corner of CEE. In fact, the idea of ROCA X was born after a speech of Daniel Dines @HowToWeb pointing out that he has been unable to find financial support in Romania and that the Venture industry is inexistent, and we’ve been fighting ever since to support the growth of this ecosystem in every way possible from hundreds of mentoring hours in incubators and accelerators to volunteer work in all legislative initiatives on Private Equity that we had access to or regional efforts.

Point is that Dreaming and hoping of a better future are essential nutrients of every successful ecosystem, but innovation comes many times from pain that we need to feel to unleash the creativity. I think we need to be aware that this ecosystem is currently bleeding in order to identify where it hurts and get a chance to cure it.

#startupventures #InvestinInRomania

Focusing just on YoY changes like the increase by 49.6% in transaction volume with local sources of capital, we lose track of the overall ecosystem evolution and the fact that 2023 has been terrible with numbers, with only 18 deals worth €12.6M in 2023 compared to 35 deals worth 15.4M in 2019. We shouldn’t either compare everything with a peak such as 2021. But the 50% increase in 2024 to €18.8M remains less than half of the activity in 2021 and 50% less than 2022. We’ve seen corrections everywhere from 2021 to the following years, but these corrections have nowhere been as abrupt as in Romania. When we step out of the absolute value variations and we look at the GDP weight or what the size and impact of the ecosystem in the overall economy is, we see how far away from the other regional ecosystems we are, with 0.041% of GDP in Romania compared to an average of 0.072% in CEE and an average of 0.46% of GDP in wider Europe.

Focusing just on YoY changes like the increase by 49.6% in transaction volume with local sources of capital, we lose track of the overall ecosystem evolution and the fact that 2023 has been terrible with numbers, with only 18 deals worth €12.6M in 2023 compared to 35 deals worth 15.4M in 2019. We shouldn’t either compare everything with a peak such as 2021. But the 50% increase in 2024 to €18.8M remains less than half of the activity in 2021 and 50% less than 2022. We’ve seen corrections everywhere from 2021 to the following years, but these corrections have nowhere been as abrupt as in Romania. When we step out of the absolute value variations and we look at the GDP weight or what the size and impact of the ecosystem in the overall economy is, we see how far away from the other regional ecosystems we are, with 0.041% of GDP in Romania compared to an average of 0.072% in CEE and an average of 0.46% of GDP in wider Europe.

I still remember the first days of ROCA X in 2019 and how fast the intensity of the tech startup events and happenings was growing every week. And I do think that a huge part of that effervescence has been generated by the success of UiPath as it showed that it is possible to have a unicorn and then a decacorn from this forgotten corner of CEE. In fact, the idea of ROCA X was born after a speech of Daniel Dines @HowToWeb pointing out that he has been unable to find financial support in Romania and that the Venture industry is inexistent, and we’ve been fighting ever since to support the growth of this ecosystem in every way possible from hundreds of mentoring hours in incubators and accelerators to volunteer work in all legislative initiatives on Private Equity that we had access to or regional efforts.

Point is that Dreaming and hoping of a better future are essential nutrients of every successful ecosystem, but innovation comes many times from pain that we need to feel to unleash the creativity. I think we need to be aware that this ecosystem is currently bleeding in order to identify where it hurts and get a chance to cure it.

#startupventures #InvestinInRomania

I still remember the first days of ROCA X in 2019 and how fast the intensity of the tech startup events and happenings was growing every week. And I do think that a huge part of that effervescence has been generated by the success of UiPath as it showed that it is possible to have a unicorn and then a decacorn from this forgotten corner of CEE. In fact, the idea of ROCA X was born after a speech of Daniel Dines @HowToWeb pointing out that he has been unable to find financial support in Romania and that the Venture industry is inexistent, and we’ve been fighting ever since to support the growth of this ecosystem in every way possible from hundreds of mentoring hours in incubators and accelerators to volunteer work in all legislative initiatives on Private Equity that we had access to or regional efforts.

Point is that Dreaming and hoping of a better future are essential nutrients of every successful ecosystem, but innovation comes many times from pain that we need to feel to unleash the creativity. I think we need to be aware that this ecosystem is currently bleeding in order to identify where it hurts and get a chance to cure it.

#startupventures #InvestinInRomania