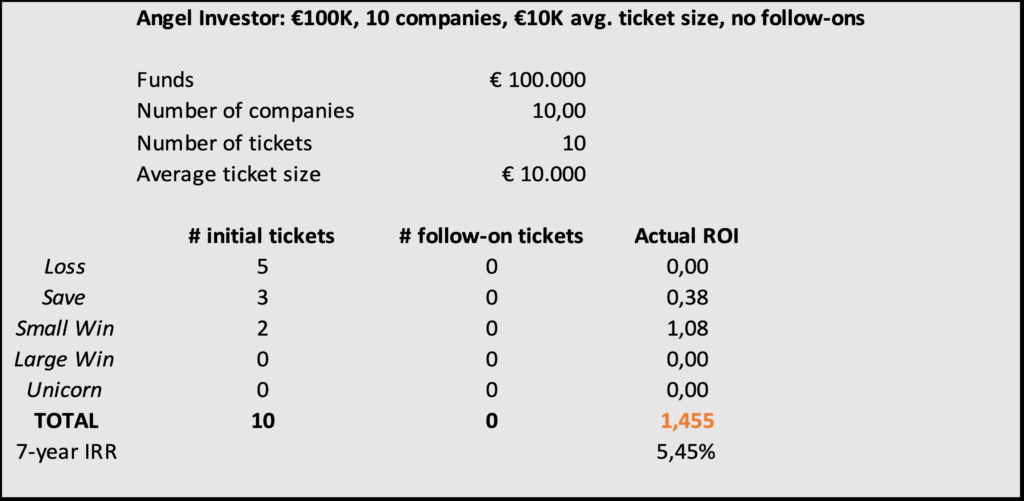

Venture Capital funds aren’t the only ones betting on companies that can deliver outsized returns. Angel Investors are increasingly looking to adapt VC-like strategies to maximize their startup investing gains: according to our survey, just like VC funds, an Angel Investor won’t support a company unless they can foresee that at some point they will receive €10 on every €1 invested.

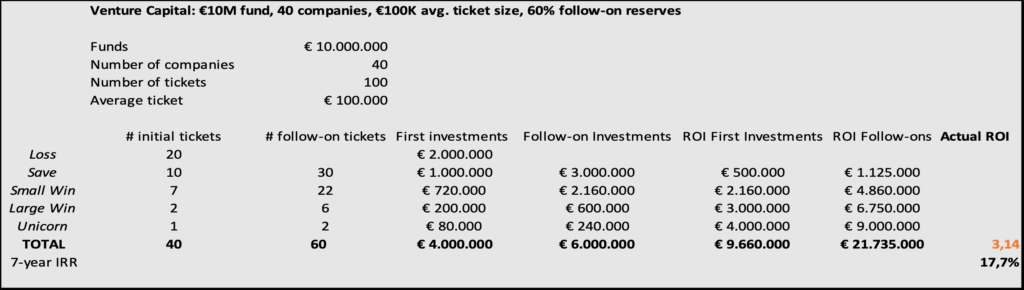

However, there are some fundamental differences between how Angel Investors and VCs invest. Even though they face the same game of probability, where 50% of investments won’t deliver much returns, while less than 10% of them will make up for the entire portfolio, Venture Capital funds usually rely on follow-on investments to deliver over 60% of their total returns.

Therefore, if you’re in the startup investing business looking for outsized returns, paying very close attention to the companies you’ve already invested in and saving more than half of your funds to double-down on winners is the key to (statistically) almost triple the returns of your portfolio.

Three key principles are required to execute on this strategy:

1) secure favorable follow-on rights for you and your affiliates,

2) have the financial power to follow-on and double-down on the companies that seems like a Save+

3) avoid investing twice in losing companies.

While point 1) is relatively straight forward to achieve, point 2) is not accessible to everybody as round sizes increase exponentially beyond Series A, and point 3) is a full-time job – often, the things that indicate that a startup is heading towards destruction will not be incapsulated within their monthly reports; sometimes the entrepreneurs themselves might not be aware of them. VCs usually employ thorough due diligence and monitoring departments to spot and mitigate potential risk factors before they happen, and fight for board positions they can be heard from and assist the company .

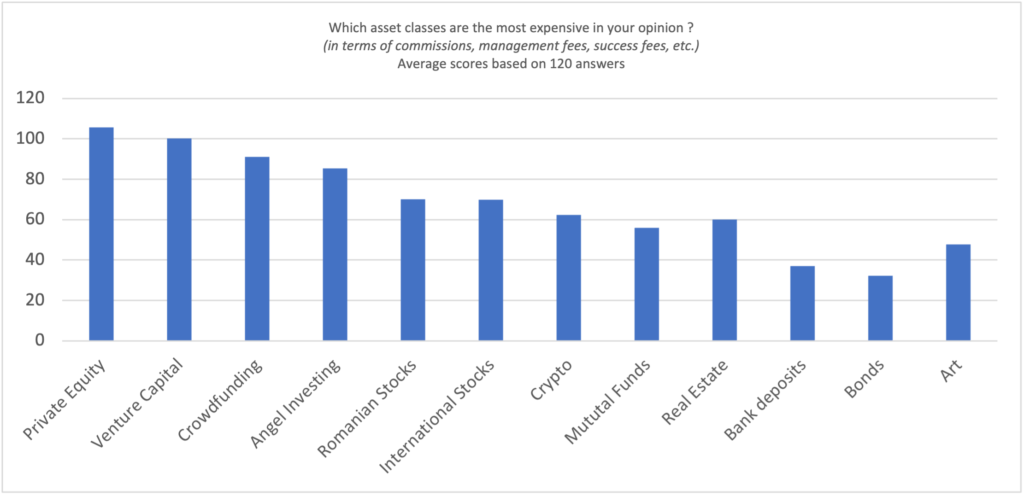

This is the reason why Limited Partners are paying their VC fund manager the 2/20 fee. However, when we asked our respondents the question “Which asset classes do you perceive to be most expensive?”, Venture Capital and Private Equity ranked on the first 2 places.

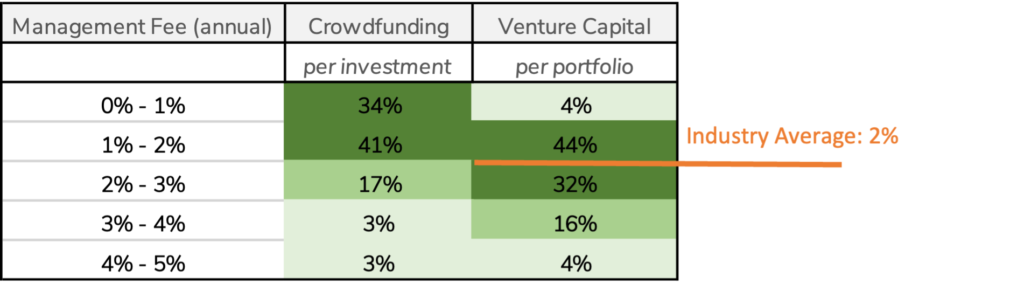

We wanted to dig deeper in this subject, so we also asked our respondents a follow-up question: “how much they are willing to pay in terms of management and success fees for different types of asset classes?.” It turns out that out of the private equities group (Angel Investing / Crowdfunding, Venture Capital, and Private Equity), our respondents are willing to pay most for Venture Capital. because of the value created….

(results as % of total respondents)

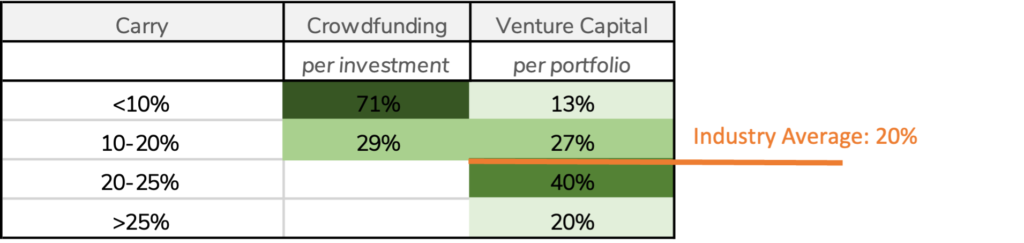

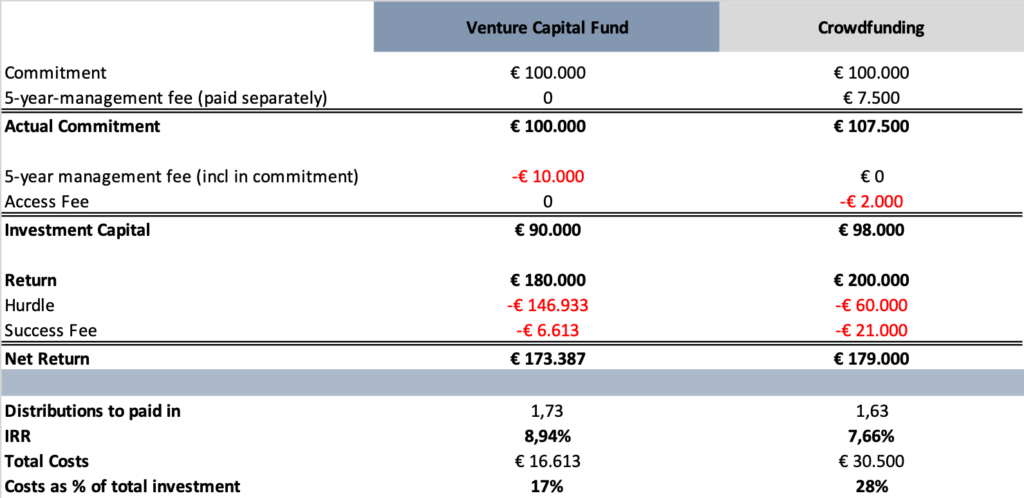

But how expensive Venture Capital really is? To answer the questions let’s go on and compare VC fees to average Crowdfunding fees.

| Access Fee | Management Fee (p.a.) | Success Fee | Hurdle Rate* | |

| Crowdfunding | 2% | 1,5% | 0% | |

| Venture Capital | 0% | 2% | 20% | 8% |

There are a few key differences between the business models of the two:

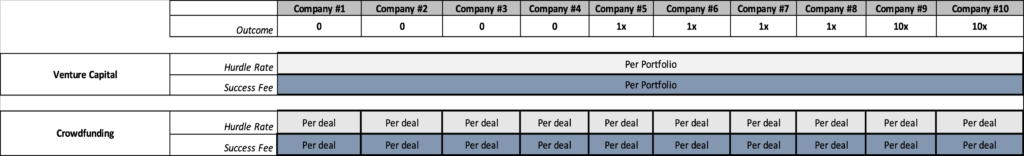

The difference in their business models result in different return scenarios for their investors. hat an investor must choose between building his or her own portfolio on a crowdfunding platform or to passively invest through a VC fund. In our example, the portfolio consists of 10 companies, out of which 4 fail, 3 deliver 1x, and 3 succeed to deliver more than 2x, according to the following scenario:

As we can see, Crowdfunding investors end up paying much higher fees compared to Venture Capital Limited Partners, reducing their overall IRR. This conclusion leaves aside the fact that VCs may be able to negotiate better follow-on rights and have better control over their investments. Also, startup investing is a full-time job, so one would naturally expect that the efforts Crowdfunders undertake to build and manage their portfolios would result in much lower costs. Paradoxically, it isn’t, and you end up owning a higher share of your profits as a LP in a VC, with less the stress.