Moving forward, one of the first findings of the survey is the extremely high return expectations that respondents have for Venture Capital as 56% expect returns between 3x (300%) and 15x (1500%) on the money invested and 44% of respondents even higher between 15x and 30x, with a median expectation of 14x that translates over a 10-year fund duration in an annual compounded IRR of >30%. Now because we are talking about industry expectations, we should think about the average return expected from the asset class – is it really that high?

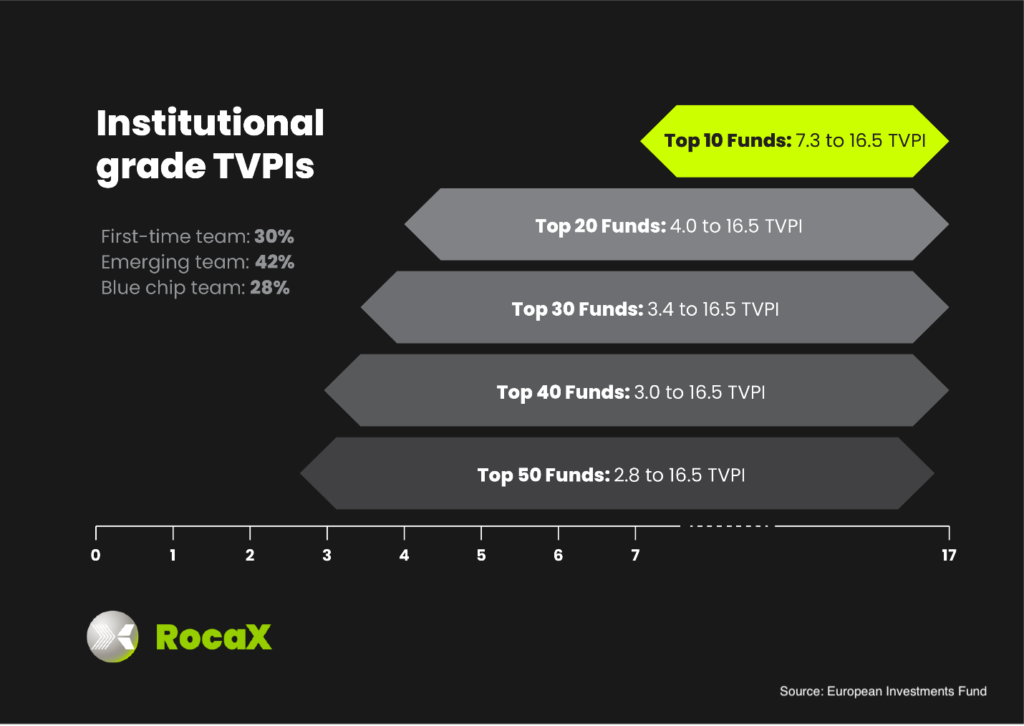

It’s probably the fault of the industry that promotes massively the success stories and uses so many multipliers like “we invest only in companies that can bring us min 10x”, stock exchange listings at valuations up to 200x annual revenues etc. According to a recent report of EIF, the most active institutional LP at European level with participations in >80% of the VCs active across the continent, top 10 VC performers had a TVPI between 7.3 and 16.5, while top 30 VC performers out of thousands go already between 3.4 and 16.5 TVPI. Going further below, the average TVPI is somewhere around 2.25 to 2.5x. But why so low? Because Venture Capital is a high-risk investment and out of 10 companies, 3-4 fail completely with no investment recovery, on another 3-4 you recover the money invested and actually everyone chases the high performers, 1 or 2 in the portfolio that have those “100x” returns and can in fact return the TVPIs for the entire fund.

So why investing in Venture Capital and lock your money for so long for these returns?

That is another misconception as although VC funds tend to have a standard duration of 10 years:

Lastly, these numbers don’t mean anything in isolation as the decision to invest in an asset class like VC comes in comparison with the performance of other asset classes that we will explore below and as part of a wealth strategy creating a diverse portfolio with a mix of assets.

We’ve asked our audience to order the investment methods based on their perceived risk degree and while it was expected that some assets like Crypto got the pole position, Crowdfunding, Angel Investing and VC investments are next in line. Are they really as risky as perceived?

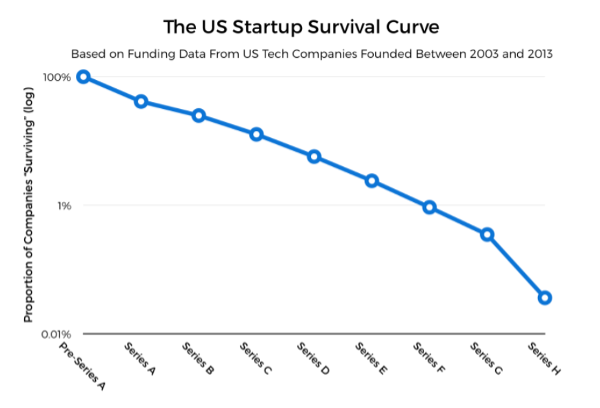

The general rule says that the earlier you invest, the bigger the risk of failure for a company and stats show that at incubator & accelerator level >90% of the initiatives fail, at pre-seed / seed level ~65% of the companies receiving capital provide returns <1x, the numbers then flip at series A where 65% of the companies receiving Series A funding make it to a Series B round, while after series B rounds only 1 in a 100 fail (sources https://spdload.com/blog/startup-success-rate/ and TechCrunch.com )

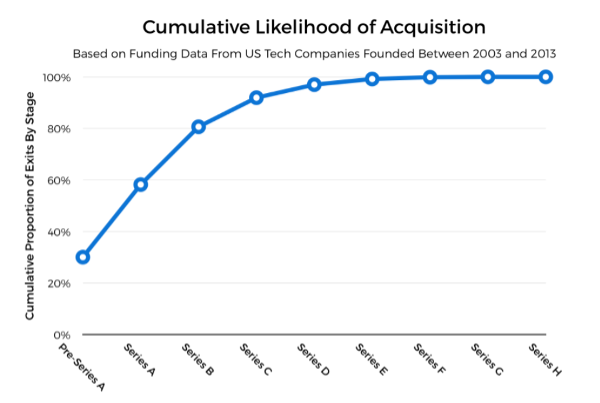

These numbers translate into a cumulative likelihood of acquisition of…

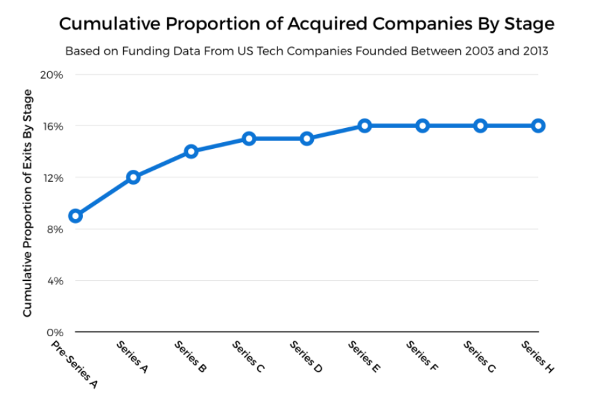

With a distribution on when a company can get acquired pretty uniform across the stages

So these stats combined with the expertise of Venture Capitalists and the trend of digital solutions adoption made the performance of Venture Capital in Europe look like this according to EIF.

Still, how do these stats look against stock exchange or real estate investments perceived as more common and safe? Unfortunately, the real estate varies too much from city to city to be able to extrapolate at asset level, with most of the results being driven by the general sentiment or economical trend and according to our respondents with expected returns of an average 14% YoY, but in stock exchange, the success rate of making a living out of trading is considered to be 4%, while just making some money out of that is 10-15%. Another stat from Investopia reveals that 80% of traders eventually fail losing the largest part of their assets.

Deposits and mutual funds are on the other hand a safer way where professionals are working to maintain your wealth, but the return rates are incomparable with the 10-20% annual returns expected by the majority of our audience.

To conclude, the proper way to evaluate an investment is using the risk-return ratio in line with your own risk profile and it might come as a surprise, but although startup investment as an asset class are indeed pretty risky, outsourced to a specialized team of a VC can return better results than more familiar asset classes.