Every time we talk about startups and the entrepreneurial ecosystem our thoughts quickly run to American success stories. It is there that the notion of Venture Capital has been born and the essential role of VCs as a driver of innovation and economic development of a country became visible. Stats show that 41% of the value traded on the public markets and 62% of the R&D spendings in US are generated by VC backed companies. Moreover, among publicly listed companies founded in the last 50 years, half of them were backed by VCs generating 2/3 of their total market value and more than 92% of their R&D budgets and patent value.

Hundreds and thousands of articles, blogs and books have been written over the last few years of glorifying the brave entrepreneurs and preaching how to build a successful startup/company and how to speed up that process by accessing financing from 3Fs, Angel Investors, VCs, CVCs etc., but very little, if none actionable content is available to support the development of venture capital, on educating the investors on their options. How can we expect to have a solid entrepreneurial ecosystem if we don’t work on growing also a strong Venture Capital industry which relies on having access to sophisticated high net worth individuals managing their wealth and successful companies in search of adopting constant innovation?

At ROCA X, we are passionate contributors to the entrepreneurial ecosystem following our mission to identify innovative founders and companies to invest in and support their growth in tomorrow’s Unicorns. And pursuing this mission, the next stage in our development as EuVECAfund manager is to raise our second fund to continue supporting even more new promising startups. We have started pre-marketing it – pre-marketing is an initial stage of the raising process in which we are able just to probe the interest on the new investment thesis without providing sufficient details (like management fee, carry percentages etc.) to allow making any firm commitments by the potential investors or as they are called in the industry Landing Partners or short LPs. While it is not our first raise, targeting a larger fund size made us go beyond our bubble of family, close friends and partners that supported us in creating our first fund and while presenting the option of investing in venture capital, for many for the first time, we have started to notice some distorted perceptions and expectation patterns repeating in the discussions we have had.

It is through this process that we have found the need and calling to dig further on the matter and share our gained knowledge on one hand with other potential VC players that will join the ecosystem as mentors in the first VC Bootcamp acceleration program created by InnovX by BCRlast autumn and even more importantly, to research deeper the Romanian market, document and share with the potential LPs the myths and realities of this industry to support them in their decision process of managing their wealth.

And since we are talking about wealth, Venture Capital cannot be seen in isolation, but in close relationship with the other investment opportunities in the market – weather we are referring to real estate, an all time favorite in developing countries, bonds and governmental securities for the more risk adverse ones or crypto for the risk lovers, investment options need to be seen in close correlation like communicating vessels in search of an equilibrium point. And for this we have designed a survey exploring what are the preferred investment methods of Romanian investors, what are the perceived risk degrees and expected returns for these investment methods, which are the commissions and taxes that investors are willing to share for these expected results and comparing them with industry stats at European level. With the help of our partners such as ZF or BCR private banking and by reaching directly to investors in Angel organizations, in stock exchange forums and associations we have collected well over 100 full questionnaires out of only a few thousands private investors active in Romania.

This series of posts will take one by one, the key findings of this survey and analyze them in the context of international industry data aiming to become a relevant information source on evaluating investment alternatives.

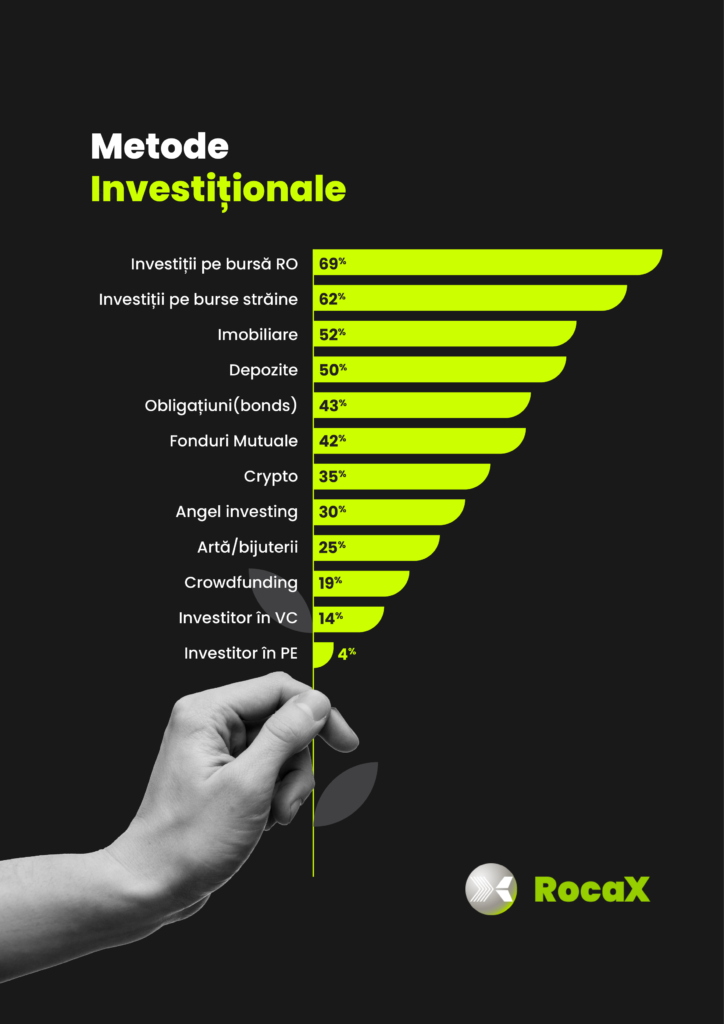

Finding #0 – first things first – in order to have relevant results, we had to understand how sophisticated and experienced our respondents were and eliminate potential irrelevant respondents. And through this question we have been able to determine the appetite that Romanian investors have for different investment method. While we were expecting that lower access barrier methods will be more popular like investments on BVB with 69% of the respondents, investments on international stock markets with 62% or the classical real estate investments with 52% of the respondents, the surprise came from the high number of crypto investors, more than 34% of the respondents including in their portfolio also this asset class. At the other end, only 14.3% of respondents became LPs in VCs and this number might be pumped up by the circle of partners we have and with an even higher average ticket and probably a closer to reality figure only 4% of our respondents ventured in supporting PE funds. The surprise however at this end came from Crowdfunding, where the access barrier is as low as 100€ on some platforms, lower even than some stock exchange brokerage houses, but still only 19% of our respondents experimented with this investment method venturing in supporting young companies.