Last year, the European venture capital market was hit by the storm. Everybody was wondering what will happen next, how long this is going to take, when and how we’ll come out of it. We all thought of the future to plan our current steps.

Our industry is basically based on dealing with uncertainty, but when the earth shook beneath our feet, the only ones that were able to stand up and fight were those who had learned how to master the unpredictability and to ride the waves of risks. The ones who kept working hard and kept investing, and not the ones who just held their ground.

And back then, almost everybody declared, in various more or less public surveys, that they will be still active no matter what. However, it’s been one year since it all started, and the conclusions drawn by studying the actual figures and deals are different from what we learned from the surveys.

Our industry is like running. You can’t stop in the middle of the race and do nothing. You’re left behind. A year without acting is one year with zero IRR. And that’s an issue in the long run which is actually not so long. With such drastic and unexpected change of landscape, “adapt” should be the word, not “stop”.

Investments in tech startups continued while Romanian startups got more and more visibility and traction abroad. Gaming, RPA, Medtech, fintech or e-learning are just a few examples of verticals that were not affected by the pandemics, and many startups in these areas had a massive opportunity in developing during the last year. Several Romanian startups achieved important milestones, scaling abroad, raising new rounds and we even saw some exits there. And we are not talking only about the UiPath success – that might be considered a catalyst for what happened with the rest of Romanian startups – but about startups like the mobile app publisher/developer T-mobile that was acquired by the US company Mocha Global, or Green Horse Games acquired by the Swiss gaming company Miniclip, both in multi-million transactions. Romanian teams supported by local business angels. Both after years of hard work and heavy growth.

There were also several new investment rounds led by international VCs. It looks like the Romanian startup ecosystem is becoming mature, and international players are starting to pay more and more attention to what’s happening here.

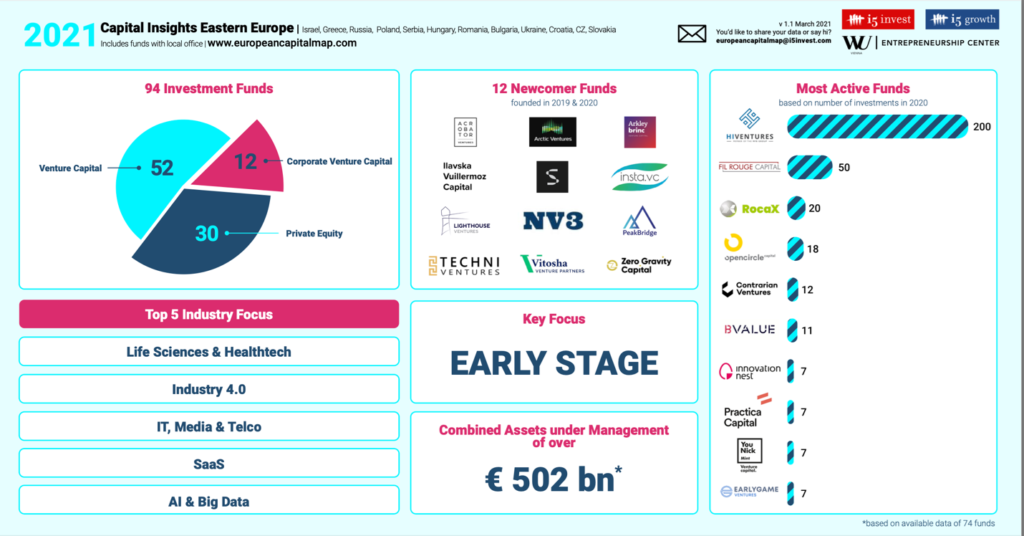

We, at Roca X, were thrilled to find ourselves among the most relevant players in CEE according to a recent i5invest study. Moreover, this study puts us as the third most active from an overall of 88 participants.

Indeed, Roca X kept looking for brilliant Romanian founders even during the pandemic, or even more, building disruptive businesses, with the vision of having an impact in society, and with the passion to turn this desire into reality. And we have supported 20 startups and had a few follow ons regarding financing.

We felt, since the spring of 2020, that e-learning and telemedicine/e-health would be short-term winners. We built upon that belief later on, when seeing that the interest, the momentum, the traction, the investments and income from those businesses were starting to allow their development, to enable the research of new solutions, etc. We relied on our instinct and supported founders in developing businesses in these industries, and we don’t have any reason to regret it. We could have focused more on the fintech and gaming industry, which were other winners-to-be in the current context, but still, we did a lot.

2020 was a year where yes, the financing support was a big concern for startups. Yet, the bigger issue for founders was where to go for help during the crisis, who could provide them guidance and management counselling during the most unpredictable times. What operational measures should they take to survive the pandemic, which of the previous development plans should they keep and how should they create a crisis scenario and budgeting were just a few of the many concerns of the startups worldwide during last year. In these terms, ROCA X simply fulfilled its mission of being side by side with the founders, providing support for their dreams to be built, but not alone, together with our team which was eager to put their know-how in the benefit of the Romanian startup ecosystem. And we helped them grow not only locally, but globally, and some of them got noticed through their performances cross-border.

Machinations.io, a Game Balancing Platform that designs, simulates and handoff game systems, spotted by us at Startup Spotlight in December 2019 managed in 2020 to raise their first few hundred thousand Euro as investment, thus being able to develop and validate many of their ideas, coming closer to a product-market fit.

Now they are looking to close a second round and are in advanced negotiation with several international VCs and prepare for Series A in 2022. We also recently connected them to one huge corporate VC, and we can feel that they are on the right path to success. But even though great things happen, international exposure it’s not new for Machinations, as they are by design a borderless global tool.

But this is not the first time big VCs from outside Romania are interested in the startups from our portfolio. As previously stated, e-learning got a good pair of wings in 2020, and our Kinderpedia, an educational management app and SaaS platform, that we decided to support in 2020 by leading their seed round, has been scouted and considered for a Series A by many European VCs looking to support their international expansion in 2021. Besides that, we supported and encouraged Kinderpedia to test international markets. They started to set a foothold in the UK, Poland, Switzerland or Portugal and they got a great partnership with the global school franchise Mapple Bear, owning 528 schools in 30 countries around the world.

Kinderpedia was also recently featured by Vestbee among the leading CEE startups that received investments last year.

Millu was one of our latest success stories. With almost 1M euro raised, we set a new record for seed rounds in Romania. Raised in one day!

Our contribution to the total round was small, we just did a follow up on our first round that we led. But our contribution to the entire round strategy paid off. Our involvement in convincing and negotiating with small funds or investors mattered most. Of course, the founders must lead every discussion in an investment round, but the support of Roca X company, and the reputation and credibility inherited from our affiliation with the large management and financial group Impetum, played a decisive role in raising this amount. While investors look after passion, commitment, and skills in a founder, they feel safer and the whole process works faster when having an institutional partner at the table, with an impressive transactions track record, able to professionally handle any contractual term or financial aspect of the deal. With this new round, Millu is going to expand internationally while planning for a series A.

Same with Ifactor, the platform that converts invoices into cash. They built an innovative online solution that brings together small-medium sized companies interested in selling their outstanding invoices for immediate cash, and investors and banks looking for diversifying their asset portfolio with a low-risk investment. We led a first seed round of almost 0.8 million Euro and help them get listed on Seedrs, as the first Romanian company to get funded there, as a first step for them to get into the UK market.

Medicai enables patient-doctor collaboration, through secure online sharing and communication no matter where they are, could be one of our next champions and along with them about half of our 22 startups portfolio that are gaining momentum and are becoming ready to expand internationally, to scale rapidly and to raise new seed and series A rounds.

There’s also our First Airborne startup from Israel, taking Europe by drones, Beez bringing their innovative shopping benefits in UK or Frisbo e-fulfilling in CEE e-commerces from Poland or Germany.

We will keep fostering our native innovation, turn great ideas led by exceptional founders into future unicorns, and keep rising the ecosystem and providing the world scalable groundbreaking solutions.